In today’s fast-paced world, businesses need reliable ways to handle payments efficiently. A smooth payment process is not only convenient for customers but also essential for maintaining trust and ensuring steady cash flow. Implementing a payment processing system can help businesses manage transactions more effectively, reduce errors, and improve the overall customer experience.

Understanding a Payment Processing System

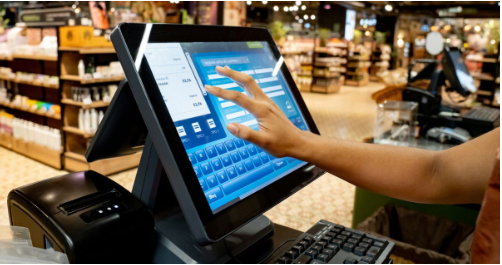

A payment processing system is a technology that allows businesses to accept payments from customers through various methods such as credit cards, debit cards, digital wallets, and online banking. It acts as a bridge between the business, the customer, and financial institutions, ensuring that funds are transferred securely and quickly. By using a payment processing system, businesses can automate much of the payment handling process, making it easier to track transactions and manage finances.

Simplifying Transactions

One of the main benefits of a payment processing system is its ability to simplify transactions. Traditional payment methods, like cash or manual checks, often involve extra steps and can lead to delays or errors. A modern payment processing system speeds up the process by instantly verifying payment details and transferring funds. This reduces waiting times for customers and helps businesses complete sales more efficiently. With a streamlined system, staff can focus more on serving customers rather than handling complicated payment procedures.

Enhancing Security

Security is a major concern for both businesses and customers. A payment processing system provides advanced security features, such as encryption and fraud detection, to protect sensitive information. These systems help prevent unauthorized access to financial data and reduce the risk of payment fraud. By ensuring secure transactions, businesses can build customer confidence and encourage repeat business.

Supporting Multiple Payment Methods

Today’s customers expect flexibility when it comes to paying for goods and services. A payment processing system allows businesses to accept a variety of payment methods, including credit cards, debit cards, mobile payments, and online transactions. This flexibility not only meets customer expectations but also increases sales opportunities. When customers can choose the payment method they prefer, they are more likely to complete a purchase, leading to higher revenue for the business.

Improving Record Keeping and Reporting

Keeping accurate records of transactions is essential for managing any business. A payment processing system automatically logs payment information, making it easier to track sales and monitor cash flow. Many systems also offer reporting features that provide insights into customer behavior, popular products, and sales trends. These reports can help business owners make informed decisions, plan for growth, and identify areas for improvement.

Enhancing Customer Experience

A smooth and quick payment process greatly improves the customer experience. Long waits or complicated payment steps can frustrate customers and negatively impact their perception of a business. With a payment processing system, transactions become faster and simpler, allowing customers to enjoy a hassle-free shopping experience. Satisfied customers are more likely to return and recommend the business to others, contributing to long-term success.

Reducing Operational Costs

Using a payment processing system can also reduce operational costs. Automating payments decreases the need for manual handling, reduces errors, and minimizes the risk of lost funds. Businesses can save time and resources by eliminating paperwork and manual reconciliation of accounts. Over time, these efficiencies translate into cost savings and improved profitability.

Conclusion

A payment processing system is an essential tool for modern businesses. By simplifying transactions, enhancing security, supporting multiple payment methods, improving record-keeping, and enhancing customer experience, it helps businesses operate more efficiently and grow successfully. Implementing such a system allows business owners to focus on what truly matters: providing excellent service and expanding their operations, while leaving the complexities of payment handling to a reliable and efficient system.